Norfolk county real estate market sees growth in sales & mortgages – February 2025

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the month of February 2025 indicate an increase in overall real estate activity compared to last year, including increases in both the total number of deeds and mortgages recorded.

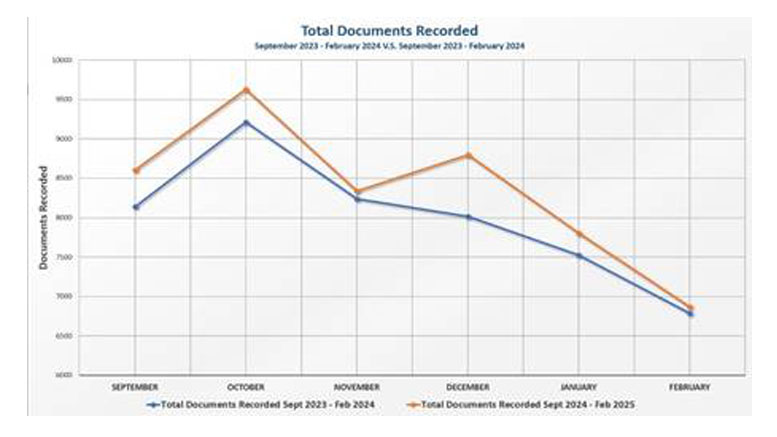

The Registry of Deeds recorded 6,870 documents in February 2025. This was 1% more than in February 2024, but a 12% decrease compared to January 2025.

“Overall, the increase in document recordings compared to the previous year is a positive indicator for the real estate market, highlighting steady growth in both commercial and residential sectors. Despite a slight dip in activity from the previous month, the year-over-year growth suggests a consistent trend for the market,” stated Norfolk County Register of Deeds William P. O’Donnell.

The total number of deeds recorded for February 2025, which reflects both commercial and residential real estate sales and transfers, was 1,035, up 8% from February 2024, but down 10% from January 2025. According to the Federal Reserve Bank, home listings in Norfolk County increased by 15% in February 2025 compared to February 2024.

“Since mid-2024, the real estate market in Norfolk County has experienced a sustained increase in the number of deeds recorded. This upward momentum has continued all the way up to the traditional homebuying season,” noted Register O’Donnell. “We will need to wait and see if this trend persists, especially as we approach the peak months for real estate activity. Factors such as interest rates, economic conditions, and the inventory of available property will play crucial roles in determining whether the market can maintain its current pace.”

In February, lending activity increased compared to the same month a year ago. A total of 983 mortgages were recorded in February 2025, up 7% from February 2024, but down 14% from January 2025. According to The Federal Home Loan Mortgage Corporation, average mortgage interest rate in February 2024 were between 6.63% and 6.94%, while in February 2025, they were between 6.76% and 6.89%.

“The increase in mortgage activity continued in February compared to the same month last year. Mortgage interest rates have remained relatively stable, staying within a narrow range compared to this time last year. Even though rates are higher than in 2021 and 2022, some borrowers still find them attractive,” stated Register O’Donnell. “As we move forward, it will be important to watch how changes in the economy and interest rates affect both the lending market and overall real estate activity in Norfolk County.”

The average sale price of commercial and residential properties for February 2025 rose to $1,061,849, a 7% increase compared to February 2024, but a decrease of 14% from January 2025. The total dollar volume of commercial and residential sales is also up, increasing by 4% from last year but down 30% from the previous month.

“Norfolk County is undeniably a sought-after location for both living and working, thanks to the vibrant communities and the dedicated efforts of municipal staff and leaders,” remarked Register O’Donnell. “However, even as property listings increase, the limited property inventory is still unable to meet the high demand. Many would agree that the market poses challenges for buyers, particularly those purchasing their first home.”

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In February 2025, there were seven foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, up from the six recorded in February 2024. Additionally, there were 19 notices to foreclose, the first step in the foreclosure process, which is fewer than the 26 recorded in February 2024.

“Unforeseen events can happen to any of us, and sometimes these events can have severe emotional and financial impacts. I urge anyone struggling to pay their mortgage, or who knows someone in this situation, to reach out to one of the non-profit organizations listed on our website, www.norfolkdeeds.org,” said Register O’Donnell

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “The real estate market in Norfolk County has shown signs of growth and stability over the past year. February 2025 saw an increase in both the total number of deeds and mortgages recorded compared to February 2024, indicating a healthy demand for property in the area. While there are some challenges with limited property inventory, especially for first-time buyers, Norfolk County continues to be a great place to live and work. As we move into the traditional home buying season, we look forward to continued growth in the months ahead.”

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at [email protected].

Be the first to comment on "Norfolk county real estate market sees growth in sales & mortgages – February 2025"