Norfolk county real estate activity rises in Q3; deeds and mortgages up

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the third quarter of 2024 (July–September 2024) indicate an increase in overall real estate activity, with increases in both the total number of deeds and mortgages recorded as compared to the third quarter of 2023.

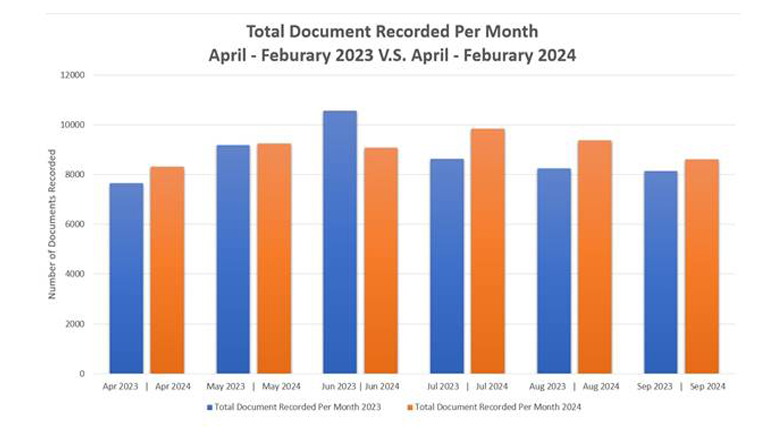

The Norfolk County Registry of Deeds recorded 27,799 documents in the third quarter of 2024. This was 6% more than the third quarter of 2023.

“Lending activity and property sales and transfers represent a majority of the documents recorded at the Registry of Deeds and the third quarter of 2024 showed some significant increase in both categories compared to last year,” noted Norfolk County Register of Deeds William P. O’Donnell. “The rise in real estate activity can likely be attributed to the availability of mortgages at lower interest rates, according to the Federal Home Loan Mortgage Corporation, not seen since September 2022.”

Overall lending activity was up for the third quarter. A total of 4,231 mortgages were recorded this quarter, 10% more than the third quarter of 2023.

“The positive trend in the number of mortgages recorded compared to last year is a sign that the recent drop in mortgage interest rates has made borrowing more attractive for potential homebuyers and borrowers, especially considering that this time last year we were seeing 31% fewer deeds recorded year over year.” Register O’Donnell added, “The Federal Reserve’s decision to lower the federal funds rate has an indirect impact on mortgage interest rates, so if hints of a continued decrease in the federal funds rate are seen, we may see lending activity continue to rise.”

The number of deeds for the third quarter of 2024, which reflect both commercial and residential real estate sales and transfers, was 4,320, an increase of 8% from the third quarter of 2023. Additionally, looking at just home sales alone, the third quarter of 2024 saw a 3% increase compared to last year.

“The significant increase in the number of property sales compared to the third quarter of 2023 is a positive sign that the real estate market is thriving, and we are seeing pockets of the market here in Norfolk County that are seeing growth and stability, particularly in certain neighborhoods and property types,” stated Register O’Donnell. “It will be important to monitor if this positive trend continues in the coming months.”

The third quarter’s sale prices have decreased compared to the third quarter of 2023. The average sale price in the third quarter was $1,065,883, an 11% decrease from the third quarter of 2023. The total dollar volume of commercial and residential sales is also down from the same period a year ago, decreasing 8% to $2,551,724,298.

“While a slight reduction in commercial and residential property prices and lower mortgage interest rates does help ease the burden of real estate costs, prices are still relatively high compared to previous years,” noted Register O’Donnell. “I think many would agree that it is a difficult market for buyers, especially first-time home buyers, due to the ongoing issue of the limited inventory of available property not just in Norfolk County but Massachusetts as a whole.”

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In the third quarter of 2024, there were 24 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in the third quarter of 2023, there were 14 recorded. Additionally, in the third quarter of 2024, there were 87 notices to foreclose, the first step in the foreclosure process, more than the 76 recorded in the third quarter of 2023.

“The substantial increase in the number of these foreclosures and notices is troubling. A significant number of our neighbors have lost their homes, and even more are dangerously close to losing them,” said O’Donnell. “We all experience unforeseen events in our lives, and sometimes events beyond our control can have devastating emotional and financial effects, so I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

O’Donnell concluded, “The third quarter of 2024 revealed a positive trend in the real estate market. The increase in documents recorded with a rise in both mortgages and deeds is a positive sign for the local real estate market, and overall, the real estate data suggests a promising outlook for the real estate market in the near future, with continued growth and stability, but only time will tell if this growth is sustainable in the long term.”

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

Be the first to comment on "Norfolk county real estate activity rises in Q3; deeds and mortgages up"