June property sales prices increase from last year, down from last month – Norfolk county real estate market update

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the month of June 2024 indicate a decrease in overall real estate activity, with decreases in property sales and transfers as compared to June 2023.

The average sale price of commercial and residential properties for June 2024 rose to $1,153,576, an 11% increase compared to June 2023 but a decrease of 8% from May 2024. The total dollar volume of commercial and residential sales is down 5% from last year but up 7% from last month.

“I think many would agree that it is a difficult market for buyers, especially first-time home buyers, due to the limited inventory of available property and an increase in property prices compared to previous years,” stated Norfolk County Register of Deeds William P. O’Donnell.

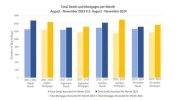

The total number of deeds recorded for June 2024, which reflects both commercial and residential real estate sales and transfers, was 1,474, down 14% from June 2023 and down 2% from May 2024. However, looking at just home sales from last month, June 2024 saw a 16% increase compared to May 2024.

“Through the late spring and early summer months, we have seen a consistent rise in property sales month over month, and as the traditional home buying season continues, we hope to see similar activity in July and August as well as an increased number of property listings, which may help alleviate some of the pressure on buyers,” stated Register O’Donnell. “However, the overall trend of a lack of inventory and increasing prices is still a concern.”

In June, lending activity decreased compared to the same month a year ago. A total of 1,390 mortgages were recorded in June 2024, down 3% from June 2023 and roughly the same number recorded last month.

“Homeowners who took advantage of lower interest rates in 2020 and 2021 are less likely to refinance and are more hesitant to buy at current mortgage interest rates. Higher interest rates also make it harder for first-time home buyers to secure affordable repayment options,” noted O’Donnell.

The Registry of Deeds recorded 9,062 documents in June 2024. This was 14% less than in June 2023, and a 2% decrease compared to May 2024.

“The number of deed recordings and mortgage recordings are significant contributors to overall real estate activity, and whenever either or both of these numbers decline, there will be a substantial decrease in the total number of recordings,” stated Norfolk County Register of Deeds William P. O’Donnell.

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In June 2024, there were 9 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, the same number recorded in June 2023. However, in June 2024, there were 37 notices to foreclose, the first step in the foreclosure process, more than the 28 recorded in June 2023.

“The number of these notices is troubling. It suggests that more of our neighbors may have financial difficulties in the future,” said O’Donnell. “If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance,” said O’Donnell.

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

O’Donnell concluded, “It comes down to the lack of available property inventory. In general, an increase in the number of properties on the market will help bring down costs. Lower costs will alleviate the effects of higher interest rates. These factors together may help increase the number of individuals who can participate in the American dream of owning a home.”

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at [email protected].

Be the first to comment on "June property sales prices increase from last year, down from last month – Norfolk county real estate market update"