Norfolk county real estate activity shows decline in first quarter of 2024: Registry of Deeds report

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the first quarter of 2024 (January-March 2024) indicate a slight decrease in overall real estate activity due to a drop in mortgage activity as compared to the first quarter of 2023.

The Norfolk County Registry of Deeds recorded 21,980 documents in the first quarter of 2024. This was 3% less than the first quarter of 2023.

“During the recently completed 2024 first quarter, the number of deeds recorded fluctuated in line with seasonal trends,” noted Norfolk County Register of Deeds William P. O’Donnell. “However, lending activity, which makes up a significant percentage of overall recordings, was down, likely due to higher interest rates relative to what they were in 2020 and 2021.”

The number of deeds for the first quarter of 2024, which reflect both commercial and residential real estate sales and transfers, was 3,262, an increase of half a percent from the first quarter of 2023.

“Real estate sales and transfers have remained steady this quarter when compared to the first quarter in 2023, but despite an increase in property listings in the first quarter of 2024, the number of available properties on the market is still not able to keep up with demand, leading to a rise in average property sales prices,” said Register O’Donnell.

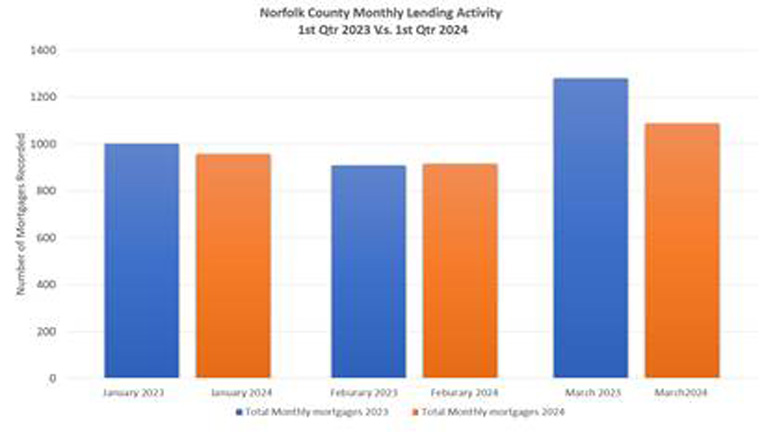

Overall lending activity was down overall for the first quarter. A total of 2,960 mortgages were recorded this quarter, 7% less than the first quarter of 2023.

“Homeowners who took advantage of lower interest rates in 2020 and 2021 are less likely to refinance and are more hesitant to buy at current mortgage interest rates. Higher interest rates also make it harder for first-time home buyers to secure affordable repayment options,” noted O’Donnell.

The first quarter’s sale prices have increased compared to the first quarter of 2023. The average sale price in the first quarter was $1,019,512, a 14% increase from the first quarter of 2023. The total dollar volume of commercial and residential sales is up $153,241,526, increasing 11% from the same period a year ago.

O’Donnell stated, “The increase in sale prices reflects the competitive real estate market in Norfolk County and Massachusetts as a whole, with the number of available properties not being able to meet demand.”

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In the first quarter of 2024, there were 29 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in the first quarter of 2023, there were 16 recorded. However, in the first quarter of 2024, there were 90 notices to foreclose, the first step in the foreclosure process, less than the 203 recorded in the first quarter of 2023.

“We cannot begin to know all the causes that have contributed to these foreclosures and notices to foreclose, but what we do know is that a number of our neighbors have lost their homes,” said Register O’Donnell. “We all experience unforeseen events in our lives, and sometimes events beyond our control can have devastating emotional and financial effects, so I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “The first quarter of 2024 revealed a real estate market that is feeling the effects of a limited inventory of available properties. The demand to both live and work in Norfolk County remains high, which is one factor contributing to the competitive market, and until more inventory becomes available, this trend is likely to persist. An increase in new home construction could alleviate some of the strain, leading to a more balanced market for buyers and sellers alike.”

Be the first to comment on "Norfolk county real estate activity shows decline in first quarter of 2024: Registry of Deeds report"