February 2024 Norfolk County records show increase in property sales and mortgage activity

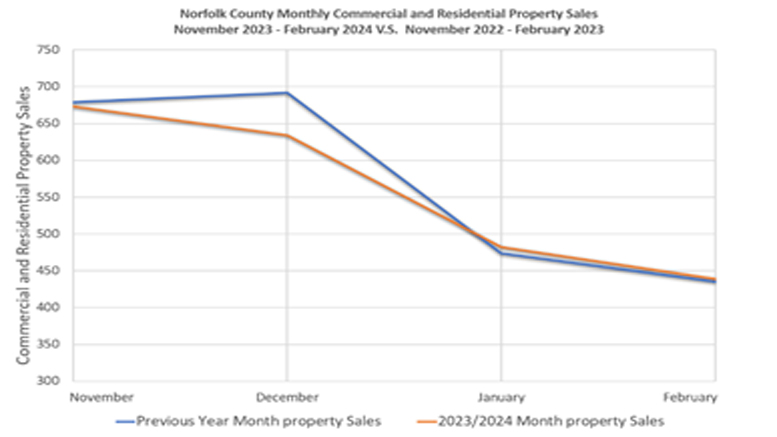

A year-over-year comparison:

Norfolk County Register of Deeds William P. O’Donnell reports that Norfolk County recordings in February 2024 show a slight increase in the total number of documents recorded, which includes an increase in property sales and mortgage recordings compared to February 2023. This marks the second month in a row that year over year property sales have increased.

The Registry of Deeds recorded 6,787 documents in February 2024. This was 1% more than in February 2023 and a 10% decrease compared to January 2024.

“Looking at the recordings from the past few months indicates that real estate activity in Norfolk County seems to be holding steady with some increases in property sales,” stated Norfolk County Register of Deeds William P. O’Donnell. “It is still very early in the year, and with the traditional home buying season yet to begin, it will be important to continue monitoring these trends and to see how external factors, such as interest rates, may impact the real estate market in the coming months to see if this positive momentum will be sustained throughout the year.”

The total number of deeds recorded for February 2024, which reflects both commercial and residential real estate sales and transfers, was 961, which was nearly equal to the number in February 2023. However, looking at just commercial and residential real estate sales, the number was up 1% from last year.

“Despite some difficult market conditions, the total number of commercial and residential property sales in February 2024 showed a slight increase compared to the previous year,” stated Register O’Donnell. “This year-over-year increase may suggest that the prospects of lower mortgage interest rates, predicted by some market observers to come down by the first half of the upcoming year in 2024, are bringing buyers to the table early.”

The average sale price of commercial and residential properties for February 2024 rose to $994,236, a 5% increase compared to February 2023 but a decrease of 2% from January 2024. The total dollar volume of commercial and residential sales is up, increasing 6% from last year but down 11% from last month.

O’Donnell noted, “With a limited supply of available properties on the market, any increase in demand is likely to cause an increase in the average property sales price. Unfortunately, when prices rise without a corresponding rise in inventory, it may result in increased competition among buyers. This makes it harder for homebuyers in general, but especially for first-time homebuyers.”

For the month of February, lending activity showed an increase compared to the same month a year ago, the first time this has happened in over a year. A total of 916 mortgages were recorded in February 2024, up 1% from February 2023 and 4% less than last month.

“The increase in lending activity this month is likely a product of the increase in the number of property transactions compared to 2023,” stated O’Donnell. “This may suggest that while some homeowners are still hesitant to make moves with average mortgage interest rates above 6%, others are not dissuaded by current interest rates, but time will tell if this trend continues.”

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In February 2024, there were 6 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in February 2023, there were 3 recorded. The total number of notices to foreclose, the first step in the foreclosure process, increased from last year, going from 26 notices in February 2023 to 43 in February 2024.

“We all experience unforeseen events in our lives. Sometimes these events are beyond our control and can have a devastating impact on our finances. I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org,” said O’Donnell.

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (617-770-2227) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

O’Donnell concluded, “Real estate activity in Norfolk County is showing some positive trends, which is a good start to the year, but the housing market still has a few hurdles to overcome, including a limited inventory of available properties on the market, which is driving up prices and making it difficult for some buyers to find affordable options. To determine whether this positive momentum will last for the entire year, it will be important to keep an eye on these trends and observe how outside factors may affect the real estate market in the upcoming months.”

Be the first to comment on "February 2024 Norfolk County records show increase in property sales and mortgage activity"