Norfolk County real estate activity sees a dip in December 2023

Reports Norfolk County Register of Deeds

Norfolk County Register of Deeds William P. O’Donnell reports that Norfolk County recordings in December 2023 show a decline in the total number of property sales and mortgages compared to December 2022 recordings. This decline can be attributed to a limited inventory of new and existing property for sale and a housing market that continues to struggle with mortgage interest rates that meet or exceed 7%.

“The limited inventory of properties for sale has created a highly competitive market with fewer opportunities for buyers,” remarked Register of Deeds William P. O’Donnell. “Additionally, higher mortgage interest rates relative to what they were in 2020 and 2021 have made it more challenging for potential homeowners, especially first-time homebuyers, to secure affordable financing options, forcing some potential homeowners to put their dreams of purchasing a home on hold.”

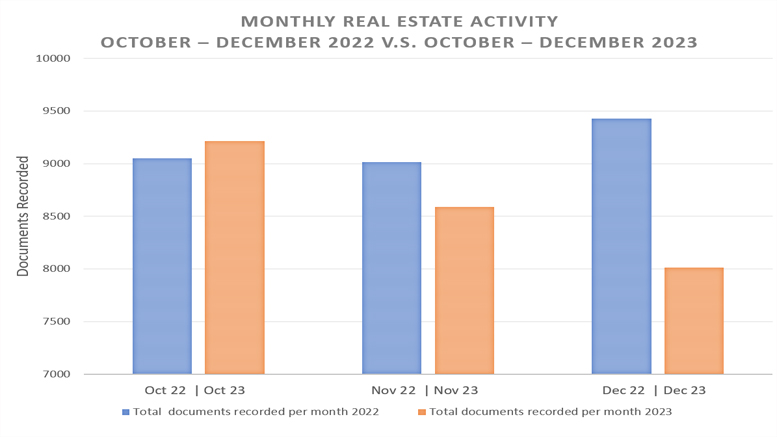

The Registry of Deeds recorded 8,015 documents in December 2023. This was 15% less than in December 2022 and a 7% decrease compared to November 2023.

“These declining numbers suggest a slowdown in the real estate market. A decrease in the number of deeds and mortgages, which make up a large portion of the total documents recorded at the Registry of Deeds, greatly impacts overall real estate activity,” noted Register O’Donnell.

The total number of deeds recorded for December 2023, which reflects both commercial and residential real estate sales and transfers, was 1,235, down 3% from December 2022 and down 2% from November of last month.

“Property prices dropped significantly in December compared to last year, and the number of property transactions was also down, which may suggest that the property price alone is not the sole factor contributing to the decrease in the number of deeds recorded at the Registry,” said Register O’Donnell.

The average sale price of commercial and residential properties for December 2023 fell to $871,249, a 7% decrease compared to December 2022 and a decrease of 9% from November 2023. The total dollar volume of commercial and residential sales is down, decreasing 15% from last year and 14% from last month.

“Seasoned homebuyers are doubly affected by current market conditions, as they not only face higher borrowing costs but also have limited options to choose from. Additionally, although home loan interest rates are coming down a little but in some cases rates still exceed 7%, so these same homeowners are also less likely to refinance, leading to a decrease in the number of mortgages being recorded,” said O’Donnell.

For the month of December, lending activity overall continued to decline from December of last year. A total of 1,124 mortgages were recorded, which is 19% less than last year and 4% less than last month.

“Those who took advantage of the lower interest rates in 2020 and 2021 are also less likely to refinance at current rates, and with property sales down, this results in a more pronounced decline in the number of mortgages recorded,” said O’Donnell. “For individuals who are struggling to keep up with payments, refinancing at a higher interest rate is not going to help.”

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In December 2023, there were 6 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in December 2022, there were 4 recorded. The total number of notices to foreclose, the first step in the foreclosure process, decreased from last year, going from 40 notices in December 2022 to 26 in December 2023. This resulted in 35% decrees in the number of notices to foreclose.

“We all experience unforeseen events in our lives. Sometimes these events are beyond our control and can have a devastating impact on our finances. I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org,” said O’Donnell.

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (617-770-2227) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

“The decrease in the number of documents recorded at the Registry of Deeds indicates a significant decline of 15% in real estate activity.” O’Donnell concluded, “This could be attributed to various factors such as rising interest rates, a lack of available inventory, or elevated property prices. It will be important to monitor these trends and see how they impact the overall real estate market in the coming months.”

To learn more about these and other Registry of Deeds events and initiatives, visit www.norfolkdeeds.org.

Be the first to comment on "Norfolk County real estate activity sees a dip in December 2023"