Norfolk county housing market shows resilience amidst challenges, Nov. report reveals steady trends

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for November 2023 show indicators of less real estate activity. However one real estate activity on a steady trend compared to November 20222 recordings was an increase in the number of deeds recorded.

“Despite the challenges posed by limited inventory and higher interest rates, the Norfolk County housing market has managed to maintain steady activity,” stated Norfolk County Register of Deeds William P. O’Donnell. “Notwithstanding a slight dip in the number of recordings this month, the housing market in Norfolk County remains resilient, with steady demand from buyers and stable property values.”

The Registry of Deeds recorded 8,587 documents in November 2023. This was 5% less than in November 2022 and a 7% decrease compared to October 2023.

Register O’Donnell noted, “Higher mortgage interest rates have an impact on the number of mortgages and deeds recorded at the Registry. Higher interest rates affect seasoned homebuyers’ eagerness to refinance, which means fewer mortgages. It also affects a homeowner’s willingness to sell, which results in fewer homes on the market that can be bought. Higher interest rates also impact a buyer’s ability to find a potential home within their budget.”

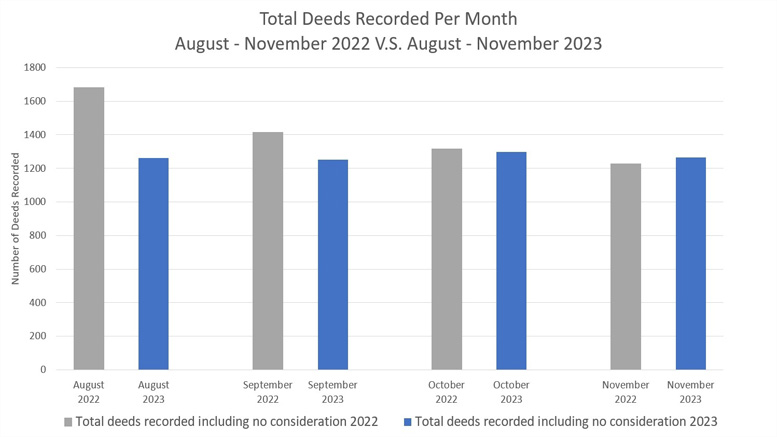

The total number of deeds recorded for November 2023, which reflects both commercial and residential real estate sales and transfers, was 1,266, up 3% from November 2022 but down 3% from October.

“The slight increase in the total number of deeds this month compared to last year shows that despite difficult market conditions and a housing market that has been slow for over a year, Norfolk County and its communities remains a desirable place to both live and work in,” noted Register O’Donnell.

The average sale price of commercial and residential properties for November 2023 was $959,272, a 1% decrease compared to November 2022 and a decrease of 1% from October 2023. The total dollar volume of commercial and residential sales is down, decreasing 2% from last year but showed less than a 1% change from last month.

“For the second month in a row, prices have remained close compared to last year’s property values, and compared to 2021, costs are down 36% and down 8% from 2020,” stated Register O’Donnell. “While prices have come down compared to previous years, high interest rates, relative to what they were in 2020 and 2021, make it difficult for homebuyers in general, but especially for first-time homebuyers looking to purchase property.”

For the month of November, lending activity overall continued to decline from last year. A total of 1,175 mortgages were recorded, which is 13% less than last year but 1% more than last month.

Register O’Donnell noted, “Those who locked in lower interest rates in 2020 and 2021 are less inclined to refinance at current mortgage interest rates, and buyers looking for new property may be hesitant to take on a new mortgage with average interest rates still above 7%. These are some of the factors that have resulted in decreased mortgage recordings.”

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In November 2023, there were 5 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in November 2023, there were 4 recorded. There were 27 notices to foreclose, the first step in the foreclosure process, which was less than the 30 recorded this month last year.

“These numbers suggest that a significant number of our neighbors are struggling, and more may have financial difficulties in the future,” said O’Donnell. “We will continue to monitor these figures, and I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

Register O’Donnell Concluded, “The current housing market climate that the country is in has a ripple effect on several aspects of the local real estate market, impacting buyers, sellers, real estate agents, and others whose livelihood is tied to the real estate sector of our economy. However, Norfolk County has shown a high level of resilience this month and saw some positive market indicators despite these challenges.”

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at [email protected].

Be the first to comment on "Norfolk county housing market shows resilience amidst challenges, Nov. report reveals steady trends"