Norfolk County housing market attempts to persevere in difficult economy

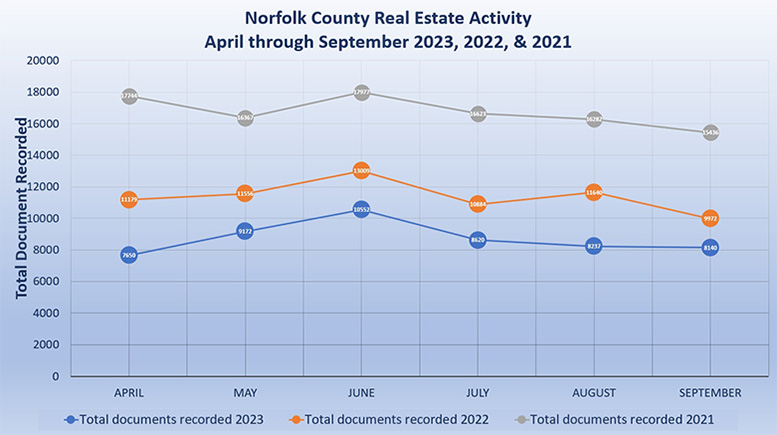

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the third quarter of 2023 indicate a continued decrease in overall real estate activity impacted by high mortgage interest rates relative to 2020 and 2021, along with a lack of inventory, However, real estate activity in Norfolk County remains significantly more active than state and national averages.

“When you look at what’s going on in the economy, I think people know things aren’t great. Buyers have been facing rising prices and rising interest rates, and home sales in Massachusetts have plummeted nearly 25% from January to August of 2023,” stated Register of Deeds William P. O’Donnell. “Fortunately, Norfolk County has come out above the statewide average for the third quarter, because in Norfolk County it was only down 14%.”

In the third quarter of 2023 (July, August, and September), the Norfolk County Registry of Deeds recorded 26,287 documents. This was 19% fewer than the third quarter of 2022.

“Looking at the statistics, we can see that fewer properties are being sold. The likely factors that are contributing to this are that while new home construction has increased in several communities, it is still not enough to keep up with the demand,” said Norfolk County Register of Deeds William P. O’Donnell. “The other factor is that existing homes remain off the market, possibly because sellers might not be selling their property because if they are selling their property, they have to buy another home to move into, and they could be paying interest rates above 7%.

The total number of deeds for the third quarter of 2023, which reflects both commercial and residential real estate sales and transfers, was 2,315, down 21% from the third quarter of 2022.

“I can understand the frustration some homebuyers may be feeling because right now it is a more complicated process for individuals looking to purchase a home and, especially, first-time homebuyers,” said register O’Donnell. “It is more expensive for home buyers because prices are still high relative to 2021 and 2020 values, and to add to this difficulty, there may be multiple people competing for the same property in a market that already has a limited inventory, especially single-family homes.”

The average sale price for the third quarter of this year was $1,195,185, an 8% increase compared to the third quarter of 2022. The total dollar volume of commercial and residential sales is down, decreasing 15% over the same period in 2022.

“Higher interest rates affect seasoned homebuyers in terms of eagerness to refinance and willingness to sell, but first-time homebuyers are particularly impacted, especially considering average prices for commercial and residential property at 2021 and 2020 values,” said Register O’Donnell. “This means that homebuyers in 2023 are paying higher property prices and a higher interest rate, resulting in a monthly mortgage payment that may not be economically feasible, particularly for first-time homebuyers who may not have the financial resources to overcome this obstacle.”

For the months of July, August, and September, lending activity overall continued to decline. During these months, a total of 3,860 mortgages were recorded, which is 31% less than the same period last year.

“Those who took advantage of the lower interest rates in 2020 and 2021 are also less likely to refinance at current rates, and with property sales going down, this results in a more pronounced decline in the number of mortgages recorded,” said Register O’Donnell.

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In the third quarter of 2023, there were 14 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in the third quarter of 2022, there were 20 recorded. Additionally, there were 76 notices to foreclose, the first step in the foreclosure process, significantly less than the 91 recorded in 2022’s third quarter.

“There is no question that these foreclosure numbers are good news. With that said, we cannot forget that foreclosure activity has a human face associated with it, and there are still a number of our neighbors who have lost their homes, and even more are dangerously close to losing their homes,” said Register O’Donnell. “I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “Overall, the housing market has slowed, especially compared to 2022’s busy home sale market, but remains relatively stable when compared to state and national averages. While current market conditions may be frustrating to some, especially for first-time homebuyers, Norfolk County has shown resilience and remains a desirable community to both live and work in.”

Follow this YouTube link to watch the 2023 Third Quarter Update segment on Quincy Access Television: www.youtube.com/watch/U9luGZRZZfE

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at [email protected].

Be the first to comment on "Norfolk County housing market attempts to persevere in difficult economy"